Crosschq Blog

Interview Fraud Detection: Your Complete Defense Guide for 2025

By 2028, globally 1 in 4 job candidates will be fake, according to research and advisory firm Gartner. Interview fraud isn't just a future concern—it's happening right now in hiring departments across America, costing companies millions and putting entire organizations at risk.

If you're a talent acquisition leader, HR professional, or hiring manager, this comprehensive guide will equip you with everything you need to detect, prevent, and respond to interview fraud before it devastates your organization.

What Is Interview Fraud Detection?

Interview fraud detection encompasses the technologies, processes, and strategies used to identify candidates who misrepresent themselves during the hiring process. This includes detecting deepfake videos, proxy candidates, AI-generated responses, falsified documents, and other deceptive practices that compromise hiring integrity.

Unlike traditional background checks that verify past employment, interview fraud detection focuses on real-time verification of candidate authenticity during the actual interview process.

The Alarming Rise of Interview Fraud: 2025 Statistics That Will Shock You

The numbers don't lie—interview fraud is exploding at an unprecedented rate:

Fraud Is Skyrocketing

After analyzing close to 200,000 data points between January 2021 and May 2023, Crosschq found that candidates are almost four times more likely to intentionally misrepresent themselves than they were in 2021.

The AI Factor

According to HYPR's 2025 State of Passwordless Identity Assurance report, 95% of organizations experienced a deepfake incident in the last year, and nearly 40% had a GenAI-related security breach.

Industry Impact

Phenom has more than 700 customers on its platform, and they include multinational conglomerates and universities. In the last year, they reported anywhere from a 50%-200% rise in poser candidates.

Financial Devastation

Companies report losing an average of $28,000 per proxy hire detection incident, encompassing investigation costs, legal fees, lost productivity, and morale damage.

How Interview Fraud Actually Works: The Methods Fraudsters Use

Understanding the enemy is your first line of defense. Here are the sophisticated tactics being deployed against hiring teams today:

1. Deepfake Technology

Modern fraudsters use AI-powered tools to create convincing fake videos during live interviews. Video Manipulation Software: Think deepfakes for live video interviews. These aren't the crude deepfakes of yesterday—they're real-time, convincing, and nearly impossible to detect without specialized tools.

2. Proxy Candidates

Proxy hiring is a sophisticated bait-and-switch scheme. You think you're hiring Jamie from Seattle, but you're actually working with someone else entirely. The qualified person interviews, but an unqualified impostor shows up for work.

3. AI-Generated Responses

Our advanced AI tools for fraud detection analyze responses and indicate to the recruiter or hiring manager if it thinks there's potential that ChatGPT, Claude or any one of the other commercially available AI tools on the market was being used to answer the questions.

4. Document Falsification

From fake diplomas to altered work histories, document fraud remains a persistent threat that's becoming more sophisticated with AI assistance.

5. Identity Theft

The worker used AI to alter a stock photo, combined with a valid but stolen U.S. identity, and got through background checks, including four video interviews, the firm said.

Red Flags: How to Spot Interview Fraud in Real-Time

Your defense starts with recognition. Watch for these warning signs during interviews:

Technical Red Flags

- Inconsistent audio/video quality: Sudden changes might indicate manipulation software

- Unnatural facial movements: Deepfakes often struggle with micro-expressions

- Response delays: Could indicate someone feeding answers off-camera

- Screen sharing anomalies: Multiple applications running or suspicious browser activity

Behavioral Red Flags

- Overly perfect answers: Responses that sound scripted or too polished

- Avoiding follow-up questions: Inability to elaborate on specific details

- Inconsistent knowledge depth: Deep knowledge in some areas, surprising gaps in others

- Camera positioning issues: Reluctance to adjust camera or show full workspace

Geographic Red Flags

While Ivan claimed to be located in western Ukraine, his IP address indicated he was actually from thousands of miles to the east, in a possible Russian military facility near the North Korean border, the company said.

Industries at Greatest Risk: Where Fraud Hits Hardest

Not all industries face equal risk. These sectors are prime targets for interview fraud:

Technology Sector

Cybersecurity and cryptocurrency firms have seen a recent surge in fake job seekers, industry experts told CNBC. As the companies are often hiring for remote roles, they present valuable targets for bad actors, these people said.

Critical Infrastructure

Perhaps the most alarming takeaway from our research is that job candidate fraud is occurring in industries where an unsuitable hire could directly impact the well-being, safety or financial security of a significant population... For example, our research uncovered job candidate fraud across school systems and healthcare organizations, as well as in financial institutions.

Remote-First Companies

Some industry experts attribute the increase in fraud to the increase in remote work. Tim Sackett, President of HRU Technical Resources commented, "I'm not surprised to see candidate fraud rise with the excessive amount of remote work that has taken place."

The Real Cost of Interview Fraud: Beyond the Headlines

The financial impact extends far beyond the obvious costs:

Direct Financial Losses

- Investigation costs: $15,000–$25,000 per case

- Legal fees: $5,000–$10,000 for contracts and potential lawsuits

- Lost productivity: Teams lose 20–30% efficiency during resolution

- Replacement hiring costs: Additional recruitment expenses

Hidden Organizational Damage

- Security breaches: Once hired, an impostor can install malware to demand a ransom from a company, or steal its customer data, trade secrets or funds.

- Team morale deterioration: When fraud is discovered, it impacts trust across the organization

- Reputation damage: Public exposure of hiring fraud can harm employer brand

- Compliance violations: Fraudulent hires can create regulatory compliance issues

Advanced Detection Technologies: Your Arsenal Against Fraud

Leading organizations are deploying sophisticated technologies to combat interview fraud:

AI-Powered Detection Systems

Phenom is the first company to develop a tool that flags potential AI-generated answers during the hiring process and provides real-time guidance to recruiters and managers.

Biometric Verification

Modern systems can verify:

- Facial recognition: Ensuring the same person appears across all interviews

- Voice pattern analysis: Detecting inconsistencies in speech patterns

- Behavioral biometrics: Analyzing typing patterns and mouse movements

Real-Time Monitoring

- Live screen sharing: Monitor candidate computer activity during interviews

- Secondary camera feeds: Multiple angles to detect hidden assistance

- Environmental scanning: 360-degree room verification before interviews begin

Best Practices for Interview Fraud Prevention

Implement these proven strategies to protect your organization:

1. Multi-Stage Verification

- Require government ID verification with live gesture requests

- Implement random verification checks throughout the hiring process

- Use different interview formats (video, phone, in-person) to ensure consistency

2. Advanced Reference Checking

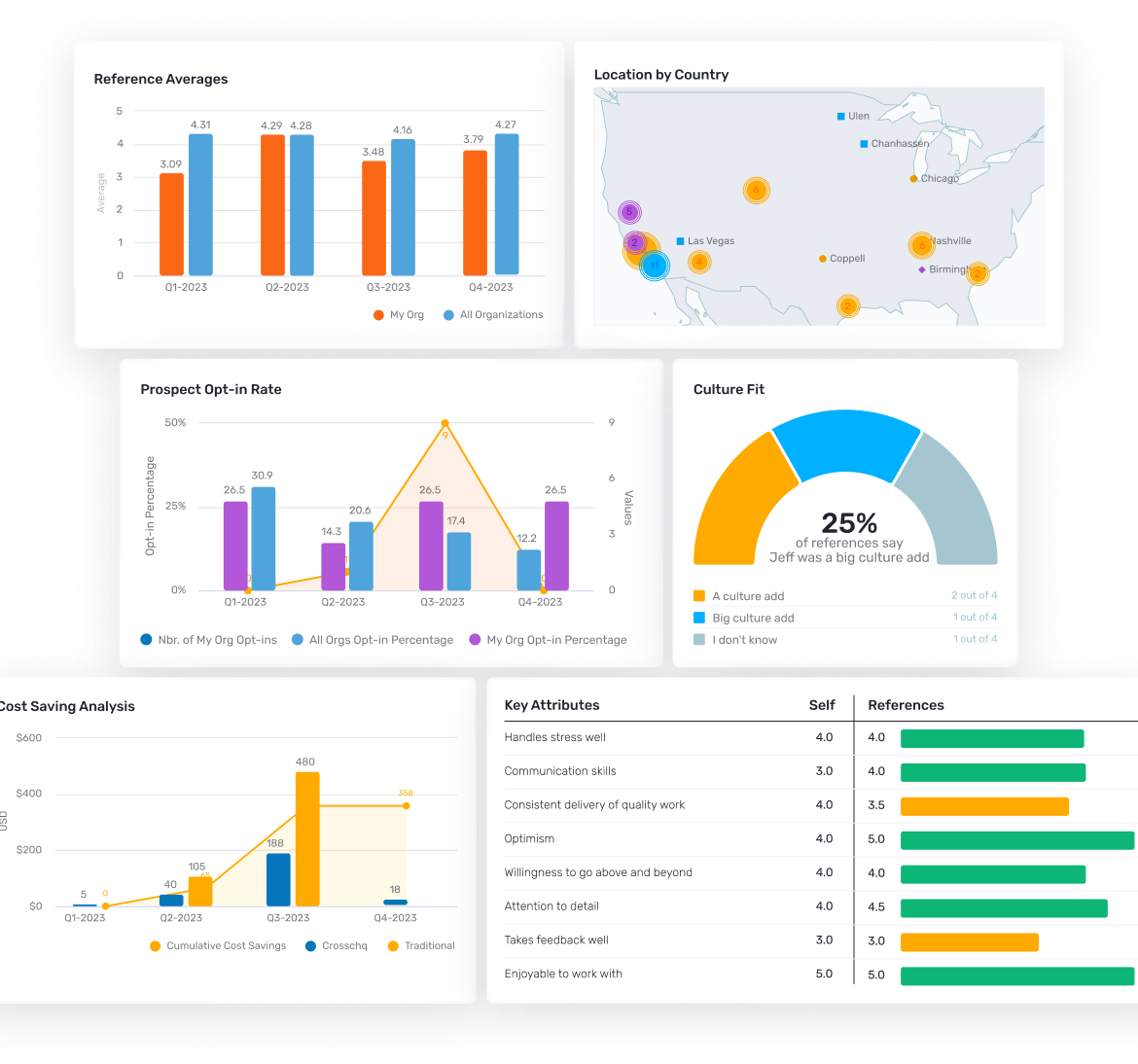

Traditional reference checks miss fraud entirely. Crosschq's 360 digital reference checks provide comprehensive fraud detection by:

- Detecting when multiple references share IP addresses

- Identifying patterns that suggest coordinated fraud

- Providing fraud alerts in real-time during the reference process

3. Interview Process Enhancement

- Record all interviews with candidate consent for later verification

- Use structured, behavioral-based questions that require specific examples

- Implement collaborative interviewing with multiple team members

- Require cameras to remain on throughout the entire interview process

4. Technology Integration

- Deploy fraud detection software that integrates with your existing ATS

- Use platforms that provide real-time fraud alerts during interviews

- Implement secure sharing capabilities for interview recordings and notes

Building a Fraud-Resistant Hiring Process

Create a comprehensive defense system with these strategic elements:

Pre-Interview Phase

- Identity verification: Require government ID and live verification

- Preliminary screening: Use reference checks before interviews to identify red flags early

- Skills verification: Implement practical assessments that can't be easily faked

During Interviews

- Environmental checks: Verify candidate workspace and ensure no unauthorized assistance

- Dynamic questioning: Ask follow-up questions that require deep, personal knowledge

- Technology monitoring: Use tools that detect AI assistance and screen sharing

Post-Interview Verification

- Consistency analysis: Compare responses across multiple interview rounds

- Reference validation: Verify that references are legitimate and provide authentic feedback

- Background integration: Ensure all verification data aligns across different sources

How Crosschq Detects and Prevents Interview Fraud

As the leader in hiring intelligence, Crosschq provides comprehensive fraud detection throughout the hiring process:

Real-Time Fraud Alerts

Crosschq's fraud detection capabilities include:

- Same IP address detection across multiple references

- Device fingerprinting to identify coordinated fraud attempts

- Behavioral pattern analysis to spot suspicious activity

Advanced Analytics

- Track fraud trends across your organization over time

- Compare your fraud rates to industry benchmarks

- Identify patterns that help prevent future fraud attempts

Integrated Solutions

- TalentWall™ provides real-time pipeline visibility

- 360 reference checks detect fraudulent references before they impact hiring decisions

- Comprehensive reporting helps track and analyze fraud patterns

Legal and Compliance Considerations

Navigate the legal landscape of fraud detection carefully:

Privacy Compliance

- Obtain explicit candidate consent for recording and monitoring

- Ensure GDPR and SOC II compliance in your fraud detection processes

- Maintain transparency about fraud detection methods used

Documentation Requirements

- Keep detailed records of fraud detection processes and outcomes

- Document decision-making processes when fraud is suspected

- Maintain audit trails for compliance and legal protection

Reference Check Legal Issues

Understanding legal boundaries in reference checking helps prevent discrimination while enabling effective fraud detection.

Future-Proofing Your Organization

Stay ahead of evolving fraud tactics with these forward-looking strategies:

Emerging Technologies

- AI detection algorithms: Tools that identify AI-generated content in real-time

- Blockchain verification: Immutable credential verification systems

- Advanced biometrics: Multi-factor biological authentication

Continuous Improvement

- Regular training for hiring teams on new fraud tactics

- Periodic review and update of fraud detection processes

- Collaboration with industry peers to share fraud intelligence

Investment in Prevention

The average cost-per-hire according to SHRM is $4,129 and the amount of time it takes to fill a position is 42 days. When you consider that bad hires can cost up to $240,000, investing in fraud prevention becomes not just smart—it's essential.

Creating a Culture of Fraud Awareness

Building organizational resilience requires more than technology:

Team Training

- Educate all hiring stakeholders about fraud risks and red flags

- Provide regular updates on new fraud tactics and prevention methods

- Create clear escalation procedures when fraud is suspected

Communication Protocols

- Establish clear lines of communication for reporting suspected fraud

- Create templates for documenting and reporting fraud incidents

- Ensure all team members understand their role in fraud prevention

Measurement and Improvement

- Track fraud detection rates and prevention effectiveness

- Measure Quality of Hire improvements resulting from better fraud prevention

- Continuously refine processes based on lessons learned

Take Action: Protect Your Organization Today

The threat of interview fraud is real, growing, and costly. But you're not powerless against it. With the right tools, processes, and awareness, you can protect your organization while continuing to hire top talent efficiently.

Start with these immediate steps:

- Audit your current hiring process for fraud vulnerabilities

- Implement basic verification requirements for all candidates

- Train your hiring team on fraud detection red flags

- Invest in technology solutions that provide real-time fraud detection

Don't wait until fraud costs your organization tens of thousands of dollars in investigation fees, legal costs, and lost productivity. The time to act is now.

Ready to build fraud-resistant hiring processes? Request a demo of Crosschq's fraud detection capabilities and see how industry leaders protect their organizations while improving Quality of Hire.

Take the Guesswork

Out of Hiring

Schedule a demo now

%20-200x43.png)