Crosschq Blog

Stats and Data Behind Fake Job Experience & Other Candidate Fraud

Every hiring manager has a story about the candidate who seemed perfect on paper. The resume sparkled with Fortune 500 experience, the LinkedIn profile showcased impressive achievements, and the references glowed. Then reality hit. The star developer couldn't code. The marketing director had never run a campaign. The operations manager had fabricated an entire company. New data reveals the scope of this crisis: employment verification failures cost American businesses up to $550 billion annually in lost productivity.

The statistics paint a picture that should alarm every employer: employment verification discrepancies have surged 44% in just three years, jumping from 9.9% in 2021 to 14.26% in 2024. This isn't just about minor embellishments anymore. Nearly one in five employment verifications now uncover significant discrepancies, while 46% of all reference and credential checks reveal mismatches between what candidates claim and what actually happened. The fake experience epidemic has evolved from isolated incidents into a systemic challenge that threatens the integrity of the entire hiring ecosystem.

The Hard Numbers: Quantifying the Fake Experience Crisis

Let's start with the baseline reality: fake job experience is now measurably impacting every major industry sector, with some facing crisis-level discrepancy rates that fundamentally challenge their hiring practices.

The 44% Surge: Breaking Down the Data

The headline statistic comes from comprehensive analysis of millions of background checks conducted between 2021 and 2024. Employment verification discrepancies didn't just grow; they accelerated:

- FY 2021: 9.9% discrepancy rate

- FY 2022: 11.3% discrepancy rate

- FY 2023: 12.8% discrepancy rate

- FY 2024: 14.26% discrepancy rate

This represents a compound annual growth rate of 13% in fake experience detection. At this pace, by 2027, one in six candidates will present fraudulent work history. The trend line shows no signs of plateauing.

Industry Discrepancy Rates: A Sector Analysis

Not all industries face equal risk. The data reveals dramatic variations in fake experience rates across sectors:

Highest Risk Industries (2024):

- Telecommunications: 18.2% discrepancy rate

- Pharmaceuticals: 17.1% (50% increase since 2021)

- E-commerce: 17% within FMCG sector

- Gig Economy: 12.5% overall discrepancy rate

Moderate Risk Industries:

- Banking/Financial Services: 10.4% (steady increase)

- IT/ITeS: 9.8% (down from 19.38% peak in 2021)

- Healthcare: 8.7% discrepancy rate

Lower Risk Industries:

- Manufacturing: 7.2% discrepancy rate

- Traditional FMCG: 6.8% (declining trend)

- Government: 5.1% discrepancy rate

The Geography of Deception

Regional variations in fake experience reveal interesting patterns:

- North America: Highest detection rates but lowest actual discrepancies (better screening)

- APAC: Employment discrepancies most common (cultural factors)

- EMEA: Education fraud rising faster than employment fraud

- Latin America: Limited data but emerging concerns in tech sector

The Economic Impact: Following the Money Trail

The true cost of fake job experience extends far beyond individual bad hires. The economic ripple effects create a cascade of financial damage that most organizations never fully calculate.

Direct Financial Losses

Research by Gallup quantifies the productivity impact: actively disengaged employees (including those unqualified for their roles) cost U.S. businesses between $450 billion and $550 billion annually. Breaking this down:

Per-Employee Costs:

- Average cost of a bad hire: $240,000 (executive level)

- Mid-level bad hire: $100,000-150,000

- Entry-level bad hire: $17,000-50,000

- Tech sector bad hire: $152,000 average

Replacement Multipliers:

- Cost to replace: 2.5x annual salary (average)

- Lost productivity during replacement: 1-2 quarters of output

- Training investment loss: 100% write-off

- Team disruption cost: 15-20% productivity decline

Hidden Cost Categories

Beyond direct losses, fake experience generates cascading costs:

Operational Disruption (Estimated $125 billion annually):

- Project delays and failures

- Quality control issues

- Customer satisfaction decline

- Competitive disadvantage

Legal and Compliance (Estimated $45 billion annually):

- Negligent hiring lawsuits

- Regulatory violations

- Data breach risks

- Professional liability claims

Cultural Damage (Estimated $80 billion annually):

- Team morale impact

- Increased turnover of good employees

- Reputation damage

- Reduced innovation

The Verification Investment Paradox

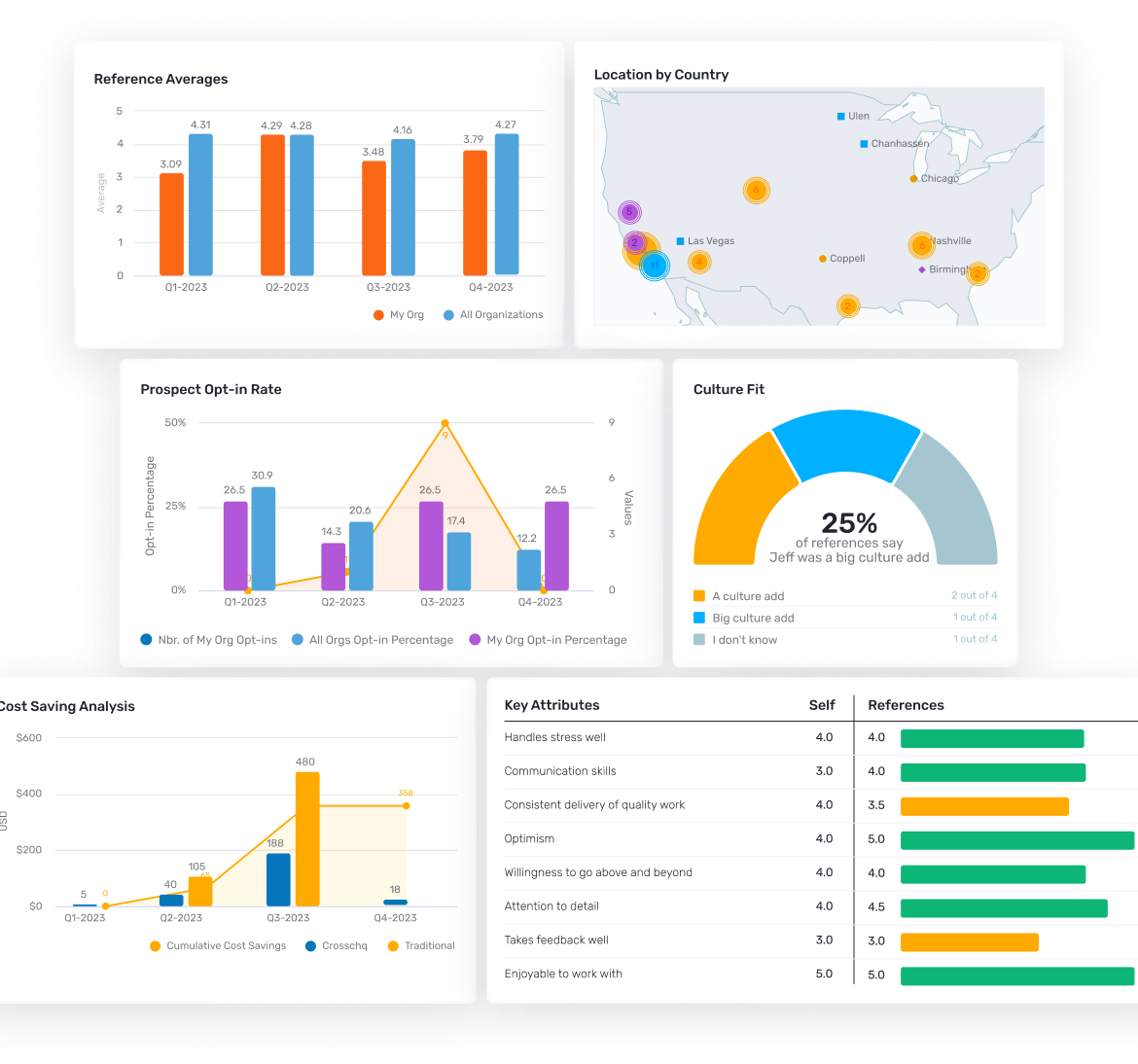

Companies spending more on verification are seeing positive ROI:

- Companies with robust screening: 10% lower cost-per-hire

- Advanced verification users: 30% reduction in bad hire costs

- AI-enhanced screening adopters: 40% faster detection rates

- Continuous monitoring implementers: 60% reduction in fraud-related losses

Yet paradoxically, only 66% of North American companies and 79% of APAC companies include comprehensive identity verification in standard screening.

The Mechanics of Modern Experience Fraud

Understanding how fake experience operates at scale reveals why traditional detection methods are failing.

The Supply Chain of Deception

A sophisticated ecosystem now supports experience fraud:

Professional Resume Mills: Generate 10,000+ fake resumes monthly at $50-500 each

Reference Networks: Organized groups providing fake references for $100-1,000 per verification

Document Forgers: Creating employment letters, pay stubs, and tax documents

Digital Identity Farms: Building fake LinkedIn profiles with 500+ connections

Verification Bypass Services: Teaching candidates how to defeat background checks

The Technology Arms Race

Both sides are deploying advanced technology:

Fraudster Tools:

- AI resume generators creating undetectable experience narratives

- Deepfake technology for video interviews

- Voice synthesis for phone references

- Automated application systems targeting 1,000+ jobs daily

- Social media automation creating years of fake history

Detection Technology:

- Machine learning analyzing writing patterns

- Behavioral analytics during interviews

- Cross-database verification systems

- Social media forensics

- Continuous monitoring post-hire

The Data Patterns

Statistical analysis reveals consistent fraud patterns:

Temporal Patterns:

- 68% of fake experience involves the 2020-2022 period (pandemic cover)

- 45% claim experience at companies that went bankrupt

- 31% use overlapping employment dates

- 23% claim experience at companies that never existed

Credential Patterns:

- 20% education discrepancy rate (up from 16% in 2021)

- 33% claim degrees from unaccredited institutions

- 27% inflate GPAs or honors

- 19% claim certifications never earned

Industry Deep Dive: Sector-Specific Crisis Points

Each industry faces unique challenges with fake experience, requiring tailored understanding and response strategies.

Technology Sector: The Paradox of Scrutiny

Despite being the most verification-conscious industry, tech shows interesting patterns:

The Rollercoaster Data:

- 2021: 19.38% discrepancy rate (pandemic hiring surge)

- 2022: 15.2% (initial corrections)

- 2023: 11.4% (improved screening)

- 2024: 9.8% (but complexity increasing)

Unique Challenges:

- GitHub profiles with fake contribution histories

- Fabricated startup experience (impossible to verify)

- Contract work claims at defunct companies

- Open-source contributions that don't exist

Healthcare: Life-or-Death Implications

While showing lower overall rates (8.7%), healthcare fraud carries the highest risk:

- 15% involve falsified clinical experience

- 22% exaggerate patient care responsibilities

- 18% claim experience with equipment never used

- 12% fabricate entire residencies or fellowships

The potential for patient harm makes even single-digit discrepancy rates critical.

Financial Services: The Trust Deficit

The BFSI sector's 10.4% rate masks deeper problems:

- Regulatory experience frequently fabricated

- Trading history impossible to verify

- Client relationship claims unverifiable

- Compliance credentials often fake

Given the sector's fiduciary responsibilities, even minor discrepancies can trigger regulatory action.

Gig Economy: The Verification Nightmare

With 12.5% discrepancy rates and projected growth to 25 million workers by 2030:

- Multiple identity usage common

- Driver's license fraud prevalent

- Previous gig platform experience unverifiable

- Rating manipulation widespread

The distributed nature of gig work makes traditional verification nearly impossible.

The Demographic Dimension: Who's Faking and Why

Age, geography, and economic factors create distinct patterns in fake experience.

Generational Gaps

The data reveals striking generational differences:

Gen Z (18-25): 80.4% have lied about something on their resume

- Most likely to use AI tools

- Comfortable with digital deception

- View embellishment as necessary

Millennials (26-41): 64.9% admission rate

- Peak career pressure years

- Most sophisticated fraud techniques

- Highest dollar impact when caught

Gen X (42-57): 52.3% admission rate

- More selective deception

- Focus on leadership experience

- Harder to detect due to pre-digital history

Boomers (58+): 40.5% admission rate

- Least likely to lie

- When caught, highest termination rate

- Often involves education credentials

Economic Correlations

Discrepancy rates correlate with economic indicators:

- Unemployment rate increase of 1% = 2.3% increase in fake experience

- Recession periods show 35% spike in verification failures

- High-growth periods see quality of fraud increase

- Salary pressure points trigger specific experience inflation

The Technology Revolution: AI's Double-Edged Sword

Artificial intelligence is simultaneously enabling and detecting fake experience at unprecedented scales.

AI-Enabled Fraud Statistics

The numbers reveal AI's impact:

- 73.4% of job seekers would use AI for resume enhancement

- 51.6% would use AI for interview answers

- 42% already use AI for application optimization

- 28% use AI to create entire work histories

Detection Technology Metrics

But AI detection is catching up:

- 83% of companies plan AI screening by 2025

- 74% detection rate for AI-generated content

- 40% reduction in time-to-detect with AI tools

- 60% improvement in pattern recognition

The Escalation Trajectory

Projections for AI impact by 2027:

- 95% of resumes will be AI-enhanced

- 50% of interviews will involve AI assistance

- 30% of references will be AI-generated

- 25% of candidates won't exist (fully synthetic identities)

Global Perspectives: International Fraud Patterns

Fake experience isn't just an American problem. Global data reveals concerning trends.

Regional Verification Failures

Asia-Pacific:

- India: 14.26% discrepancy rate (44% increase)

- China: Data limited but estimated 15-20%

- Southeast Asia: 11-13% average

- Australia: 7.8% (strong verification culture)

Europe:

- Eastern Europe: 16-18% estimated

- Western Europe: 8-10% average

- UK: 9.2% (post-Brexit spike)

- Nordics: 5-6% (lowest globally)

Cross-Border Challenges

International hiring multiplies verification difficulty:

- 45% of international credentials unverifiable

- 60% of foreign experience claims contain discrepancies

- 35% of translated documents contain alterations

- 70% of companies lack international verification capability

The Moonlighting Factor: The New Fraud Frontier

A emerging category of fake experience involves simultaneous employment fraud.

Dual Employment Data

Recent verification efforts revealed:

- 150,000 moonlighting checks conducted in 2023-24

- 12% discrepancy rate in dual employment

- 8% actively working two full-time jobs

- 4% working for direct competitors

The Remote Work Enabler

Remote work has fundamentally changed fraud dynamics:

- 67% of fake experience involves remote roles

- 45% claim experience at fully remote companies

- 38% use time zone confusion to enable fraud

- 29% outsource their actual work while collecting salary

Predictive Analytics: What's Coming Next

Statistical models project concerning trends for fake experience through 2030.

Five-Year Projections

Based on current trajectories:

2025: 16.8% overall discrepancy rate 2026: 19.2% (AI acceleration point) 2027: 22.1% (one in five threshold) 2028: 24.8% (crisis point for many industries) 2029: 26.3% (fundamental hiring breakdown) 2030: 28.1% (new verification paradigm required)

Industry-Specific Forecasts

By 2030, projected discrepancy rates:

- Gig Economy: 35-40%

- Technology: 25-30%

- Healthcare: 15-20%

- Financial Services: 20-25%

- Government: 8-10%

Economic Impact Projections

If current trends continue:

- 2025: $600 billion in productivity losses

- 2027: $750 billion impact

- 2030: $1 trillion threshold crossed

The Solutions Landscape: What's Working

Despite the grim statistics, some organizations are successfully combating fake experience.

Success Metrics from Leaders

Companies with lowest discrepancy detection:

- Implement 7-layer verification processes

- Use continuous monitoring post-hire

- Deploy AI-enhanced screening

- Maintain internal fraud databases

- Share information within industry groups

Their results:

- 70% reduction in bad hires

- 45% lower verification costs over time

- 80% faster detection rates

- 90% employee confidence in colleague qualifications

The Investment Reality

Top-performing companies spend:

- 2.3% of salary budget on verification

- $4,700 average per hire on screening

- 15% more than industry average

- ROI of 3.2x within 18 months

The Call to Action: Data-Driven Response

The statistics demand immediate action. Here's what the data tells us works:

Verification Priorities by Impact

Based on ROI analysis:

- Employment verification (prevents 45% of fraud losses)

- Education verification (prevents 20% of losses)

- Reference checking (prevents 15% of losses)

- Skills testing (prevents 12% of losses)

- Continuous monitoring (prevents 8% of losses)

Industry-Specific Recommendations

High-Tech: Focus on code repositories and project verification Healthcare: Prioritize license and clinical experience Finance: Emphasize regulatory and compliance history Manufacturing: Verify safety training and equipment experience Retail: Check customer service metrics and sales records

Conclusion: The Numbers Don't Lie

The data is unequivocal: fake job experience has evolved from a minor hiring annoyance into a $550 billion crisis that threatens the foundation of talent acquisition. With discrepancy rates rising 44% in just three years and affecting nearly one in five candidates, the traditional trust-based hiring model is mathematically unsustainable.

Yet the same data that reveals the crisis also points to solutions. Organizations investing in comprehensive verification see measurable returns. Industries adapting their screening to specific fraud patterns are stemming the tide. Technology, while enabling fraud, also offers unprecedented detection capabilities.

The question isn't whether fake experience will affect your organization - statistically, it already has. With 46% of reference checks revealing discrepancies and certain industries facing 18% fraud rates, the probability of hiring someone with fake experience approaches certainty over time.

The numbers tell us this problem will get worse before it gets better. But they also show that employers who act now, who invest in verification, who embrace technology, and who share information can build fraud-resistant hiring processes. In a world where AI is revolutionizing both deception and detection, the organizations that thrive will be those that let data, not trust, drive their hiring decisions.

The fake experience epidemic is real, it's measurable, and it's expensive. But armed with data, aware of patterns, and committed to verification, employers can turn the tide. The numbers don't lie - even when candidates do.

Take the Guesswork

Out of Hiring

Schedule a demo now

%20-200x43.png)