Crosschq Blog

Resume Fraud: The $600 Billion Crisis Transforming How Organizations Verify Talent in 2025

The hiring industry faces an uncomfortable truth. Over half of job applicants have admitted to lying on their resumes, while 85% of hiring managers report catching lies during their screening process. Yet despite this vigilance, resume fraud continues to cost U.S. businesses an estimated $600 billion annually. The real crisis isn't just the prevalence of deception—it's the fundamental inadequacy of our verification systems in an era where AI can generate convincing falsifications in minutes.

After analyzing thousands of hiring fraud cases across industries, a disturbing pattern emerges. Organizations aren't just failing to detect resume fraud; they're discovering that traditional verification methods are becoming obsolete against increasingly sophisticated deception tactics.

The Evolution of Deception: From White Lies to Systematic Fraud

Resume fraud has evolved far beyond the classic "slight embellishment" of responsibilities or the strategic extension of employment dates. Today's resume fraud represents a fundamental shift toward systematic deception enabled by technology and sophisticated fraud networks.

A January 2025 Resume Builder survey revealed that 44% of respondents admitted to lying during the hiring process, with 24% falsifying their resumes specifically. But these statistics only capture admitted deception—the true scope likely extends much further as detection methods struggle to keep pace with evolving fraud techniques.

The Sophistication Revolution

Modern resume fraud operates on multiple levels of complexity. AI tools generate convincing resumes and cover letters in minutes, while deepfake technology enables imposters to create authentic-seeming professional photos and even pass video interviews. State-sponsored actors use stolen identities to infiltrate organizations, creating elaborate professional histories that can withstand basic verification processes.

The most concerning trend involves the emergence of professional fraud services that create comprehensive fake professional identities, complete with fabricated employment histories, educational credentials, and even coordinated reference networks. These services represent industrialized deception that traditional hiring verification simply cannot combat.

The Hidden Costs: Beyond the $600 Billion Price Tag

The financial impact of resume fraud extends far beyond direct hiring costs. Organizations face cascading consequences that traditional cost calculations often miss:

Operational Devastation

Hiring someone based on a fraudulent resume can cost companies up to $17,000 in direct expenses, but the operational impact often exceeds financial calculations. Teams become demoralized when carrying unqualified colleagues, productivity declines as mistakes require correction, and client relationships suffer when promised expertise proves nonexistent.

Security and Compliance Risks

Perhaps most critically, resume fraud creates security vulnerabilities that can devastate organizations. Once hired, imposters can install malware, steal customer data, access trade secrets, or create compliance violations that result in regulatory penalties. The cost of a single data breach attributed to a fraudulent hire can reach millions of dollars.

Cultural and Reputation Damage

Resume fraud erodes organizational trust at fundamental levels. When fraud is discovered, it impacts team dynamics, creates suspicion around other hires, and damages employer brand reputation. The intangible costs of cultural deterioration and reputational harm often exceed the direct financial impact.

The Detection Challenge: Why Traditional Verification Fails

The reason resume fraud continues to proliferate despite widespread awareness lies in the fundamental limitations of traditional verification approaches. Most organizations rely on methods designed for an era of simpler deception, leaving them vulnerable to modern fraud tactics.

The Reference Checking Vulnerability

Traditional reference checking represents the weakest link in most verification processes. A shocking 15% of applicants have provided fake references, including fictional characters or coordinated fraud networks. These fake references often withstand basic verification because organizations lack sophisticated detection capabilities.

The Education Verification Gap

Educational fraud has become increasingly sophisticated, with candidates using diploma mills, paying hackers to add their names to university databases, or leveraging AI to create convincing fake transcripts. The verification process for educational credentials often relies on outdated methods that fraudsters have learned to circumvent.

The Employment History Maze

Nearly 40% of candidates have altered their previous job titles, while 30% have manipulated employment dates to hide gaps. The decentralized nature of employment verification makes comprehensive validation time-intensive and often incomplete, creating opportunities for systematic deception.

The Technology Arms Race: AI-Powered Fraud vs. Detection

The rise of AI has fundamentally altered the resume fraud landscape, creating an arms race between increasingly sophisticated fraud techniques and detection technologies. Organizations must understand this dynamic to build effective defense strategies.

AI-Generated Professional Identities

Modern fraudsters use AI to create comprehensive professional personas, including:

- AI-generated professional photographs that appear authentic across platforms

- Sophisticated work histories with industry-appropriate terminology and achievements

- Coordinated social media profiles that support fabricated professional narratives

- Dynamic reference networks where multiple fake personas support each other's claims

Advanced Detection Technologies

Leading organizations are deploying sophisticated technologies to combat AI-powered fraud:

- AI detection tools that identify synthetically generated content in resumes and photos

- Cross-platform verification systems that correlate information across multiple sources

- Behavioral analysis algorithms that identify suspicious patterns in application materials

- Blockchain-based credential verification that creates tamper-proof educational and employment records

The Integrated Security Imperative: Building Comprehensive Fraud Defense

The most effective approach to resume fraud prevention requires integrated security measures that address the full spectrum of potential deception. Organizations can no longer rely on single-point verification; they need comprehensive fraud defense ecosystems.

Essential Security Foundations

Modern resume fraud prevention requires multiple layered protections:

- Comprehensive interview fraud detection to identify candidates using deepfakes, proxy interviewing, or AI-generated responses

- Advanced candidate screening protocols that validate identity and credentials before deeper evaluation begins

- Sophisticated fake candidate identification during video interviews and assessment processes

- AI-powered interview analysis that cross-references behavioral patterns with verified historical data

- Intelligent interview platforms that integrate multiple verification methods into seamless evaluation workflows

The Reference Intelligence Connection

The most critical component of resume fraud prevention involves comprehensive reference verification that goes beyond traditional checking methods. Advanced reference intelligence platforms can detect coordinated fraud attempts, identify suspicious patterns across multiple candidates, and provide verification that withstands sophisticated deception tactics.

Industry-Specific Vulnerability Assessment

Resume fraud impact varies significantly across industries, with certain sectors facing disproportionate risks due to their hiring practices, remote work policies, and regulatory requirements.

High-Risk Sectors

Information Technology

The IT industry experiences the highest rates of resume fraud, with 55% of employees admitting to falsification. The technical nature of roles, prevalence of remote work, and reliance on skills-based assessment create opportunities for sophisticated deception.

Financial Services

Finance ranks second in fraud prevalence at 45%, with particular vulnerability in areas requiring specialized certifications or regulatory compliance. The high compensation levels and prestige associated with financial roles create strong incentives for resume fraud.

Healthcare and Life Sciences

Healthcare fraud presents unique risks due to patient safety implications and regulatory requirements. Fraudulent credentials in medical roles can result in malpractice liability, regulatory violations, and potentially life-threatening consequences.

Remote-First Organizations

Companies with distributed workforces face elevated fraud risks due to limited in-person verification opportunities and reliance on digital credential validation. The geographic distribution of candidates makes traditional verification methods more challenging and expensive.

The Strategic Response: Building Fraud-Resistant Hiring Intelligence

Organizations that successfully combat resume fraud don't simply implement better detection tools—they fundamentally transform their approach to candidate verification and hiring intelligence. This transformation requires strategic thinking about fraud prevention as part of comprehensive talent assessment.

The Predictive Prevention Model

Rather than reactive fraud detection, leading organizations are implementing predictive prevention systems that identify fraud indicators before they impact hiring decisions. These systems use pattern recognition to flag suspicious applications, correlate candidate information across multiple data sources, and automatically trigger enhanced verification protocols.

The Ecosystem Approach

The most effective fraud prevention emerges from integrated hiring intelligence ecosystems that combine multiple verification methods, real-time fraud detection, and comprehensive candidate assessment. These systems don't just prevent fraud—they improve overall hiring quality by providing deeper insights into candidate authenticity and capability.

The Continuous Learning Framework

Fraud tactics evolve rapidly, requiring organizations to implement continuous learning systems that adapt to new threats. The most successful programs include regular fraud pattern analysis, emerging threat intelligence integration, and systematic improvement of detection capabilities.

The Reference Intelligence Revolution: Verifying Beyond the Resume

While resume fraud focuses attention on document falsification, the most critical verification happens through comprehensive reference intelligence that validates actual work performance and behavior patterns. This verification cannot be faked or manipulated through AI tools, making it the cornerstone of effective fraud prevention.

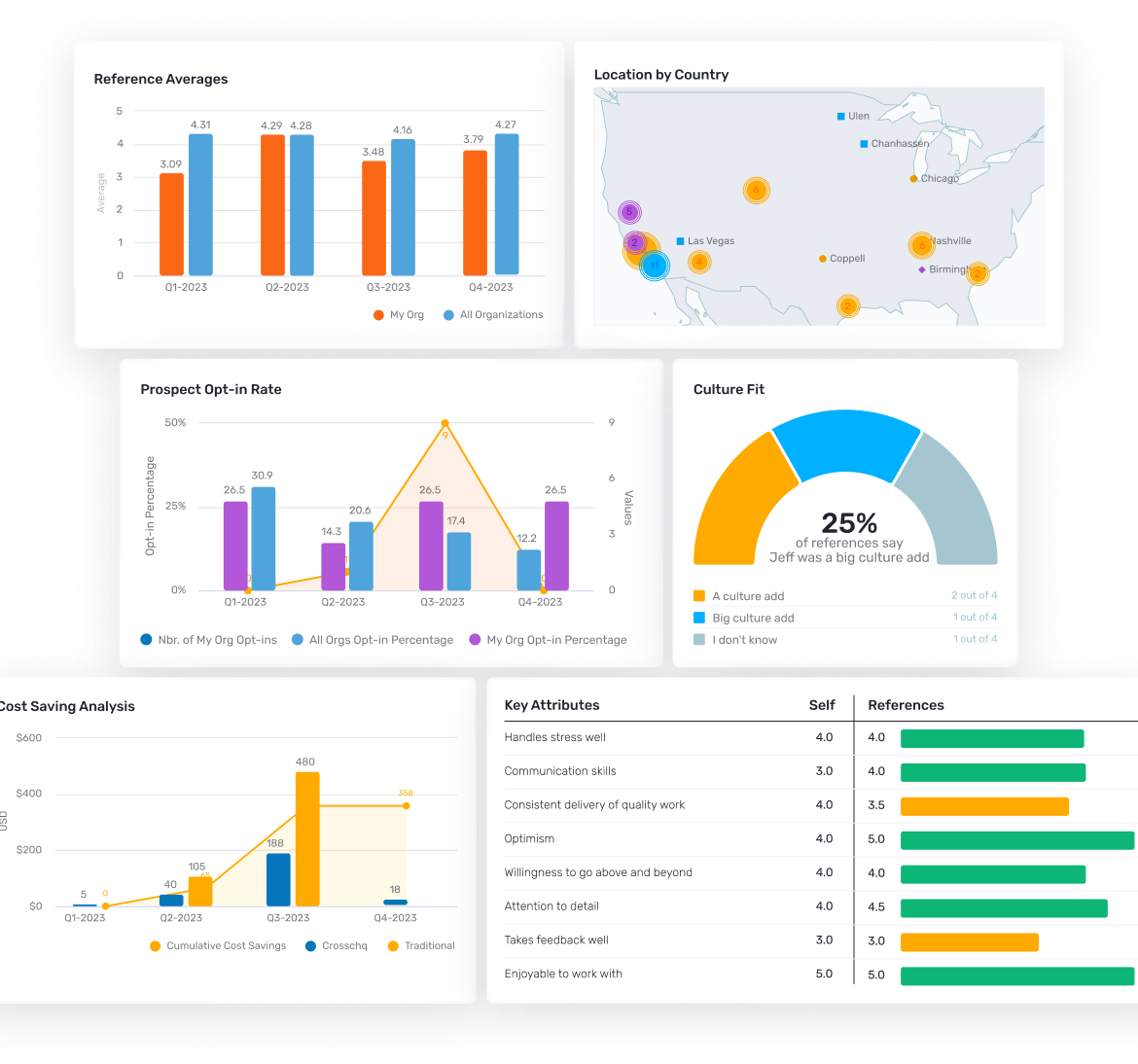

At Crosschq, we've observed that organizations with comprehensive reference intelligence capabilities detect resume fraud at significantly higher rates than those relying on traditional verification methods. When resume claims are cross-referenced against verified performance history and behavioral evidence from past work relationships, inconsistencies become apparent that document verification alone cannot reveal.

Advanced Reference Verification

Modern reference intelligence goes far beyond basic employment confirmation to include:

- Fraud pattern detection across multiple reference sources

- IP address analysis to identify coordinated fake reference networks

- Behavioral consistency verification between resume claims and actual work patterns

- Performance correlation analysis that validates claimed achievements against verified outcomes

The Integration Advantage

The most sophisticated hiring intelligence platforms integrate resume verification with comprehensive reference checking and interview analysis, creating multi-dimensional fraud detection that no single verification method can provide. This integration enables organizations to build complete candidate authenticity profiles that withstand even sophisticated fraud attempts.

The Cultural Transformation: Moving Beyond Detection to Prevention

The most successful approaches to resume fraud don't focus solely on catching deception—they create hiring cultures and processes that make fraud less attractive and more likely to be discovered. This cultural transformation requires leadership commitment and systematic change management.

Transparency as Prevention

Organizations that communicate clearly about their verification processes and fraud detection capabilities often deter fraudulent applications before they occur. When candidates understand that comprehensive verification is standard practice, many choose not to risk exposure through fraudulent applications.

The Ethics Integration

Leading organizations integrate ethical assessment into their hiring processes, evaluating candidate integrity through behavioral interviews, reference verification, and ethical scenario evaluation. This comprehensive approach identifies candidates who demonstrate authentic integrity rather than simply avoiding detection.

The Long-Term Perspective

The most effective fraud prevention programs take long-term approaches that continuously improve detection capabilities, update verification methods, and adapt to emerging threats. These programs view fraud prevention as an ongoing strategic priority rather than a one-time implementation challenge.

The Future of Fraud Prevention: Emerging Technologies and Strategies

As resume fraud continues evolving, organizations must prepare for emerging threats while building increasingly sophisticated defense capabilities. The future of fraud prevention will likely involve technologies and approaches that seem futuristic today but will become standard practice within years.

Blockchain Verification Systems

Emerging blockchain-based credential verification systems promise tamper-proof educational and employment records that could eliminate many forms of resume fraud. These systems create immutable verification trails that fraudsters cannot manipulate or circumvent.

Biometric Identity Verification

Advanced biometric systems that verify candidate identity across multiple touchpoints in the hiring process will make impersonation and proxy fraud significantly more difficult. These systems can ensure that the same person completes assessments, interviews, and verification processes.

Predictive Fraud Modeling

Machine learning systems that analyze vast datasets of fraud patterns will enable predictive identification of fraudulent applications before human reviewers invest time in evaluation. These systems will continuously improve their accuracy through exposure to new fraud patterns and techniques.

The Strategic Choice: Adaptation or Vulnerability

Organizations face a fundamental choice in how they approach resume fraud. They can continue using traditional verification methods that provide false confidence while remaining vulnerable to sophisticated fraud, or they can invest in comprehensive fraud prevention systems that address the full spectrum of modern deception tactics.

The companies choosing comprehensive fraud prevention are building hiring intelligence capabilities that will define competitive advantage in talent acquisition. They're not just protecting against fraud—they're developing superior talent assessment capabilities that improve overall hiring quality and organizational performance.

The Integration Imperative

The most successful organizations integrate fraud prevention into comprehensive hiring intelligence platforms that combine multiple verification methods, advanced analytics, and continuous improvement capabilities. This holistic approach creates sustainable fraud prevention that adapts to evolving threats while improving overall hiring effectiveness.

The Competitive Reality

As fraud tactics become more sophisticated, competitive advantage increasingly belongs to organizations that can reliably verify candidate authenticity and build hiring processes that attract honest, high-quality candidates while deterring fraudulent applications.

The Path Forward: Building Unshakeable Hiring Integrity

The resume fraud crisis represents both a significant challenge and a transformational opportunity for organizations willing to invest in comprehensive fraud prevention. The companies that emerge as leaders will be those that view fraud prevention not as a defensive necessity, but as a strategic capability that enables superior talent assessment and competitive advantage.

The future belongs to organizations that can seamlessly integrate fraud prevention with hiring intelligence to create evaluation processes that are both fraud-resistant and capable of identifying exceptional talent. These systems don't just prevent deception—they enable deeper insights into candidate potential and organizational fit.

The most successful organizations integrate resume fraud prevention into comprehensive hiring intelligence platforms that provide superior candidate assessment while maintaining unshakeable verification integrity. This integrated approach doesn't just solve the fraud problem—it creates competitive advantages in talent acquisition that compound over time.

The $600 billion cost of resume fraud isn't just about detection—it's about building hiring intelligence systems that make deception impossible while enabling unprecedented insight into candidate potential.

The choice is clear: adapt to the new reality of sophisticated fraud, or remain vulnerable to increasingly costly deception. The organizations that act decisively today will build the fraud-resistant hiring capabilities that define tomorrow's talent acquisition leaders.

Take the Guesswork

Out of Hiring

Schedule a demo now

%20-200x43.png)